In the vast arena of business, where the tide of uncertainty ebbs and flows, small enterprises often find themselves adrift against the relentless waves of risk. While the emblem of success can seem tantalizingly within reach, the voyage towards prosperity requires the unwavering fortification provided by a trusty insurance policy. Alas, even with the best intentions, many small business owners unwittingly fall prey to the treacherous pitfalls that lie in wait during the insurance buying process.

In this enlightening expedition, we embark upon a journey of discovery, aiming to decode the bewildering maze of insurance purchasing for small businesses. Brace yourself, for we shall meticulously expose the top 11 missteps that entrepreneurs frequently stumble upon when navigating the complex universe of insurance plans, coverage, and policies.

Fear not, for our intentions are not to judge or chastise, but to illuminate the path towards insurance enlightenment. With a creative flair and a neutral tone, we shall unravel the misconceptions and unveil the hidden lessons gleaned from countless tales of trial and tribulation. So, let us embark on this voyage together, ensuring that your business is fortified against the tempestuous winds of unpredictability.

Table of Contents

- 1. Not having general liability insurance

- 2. Buying insurance from the cheapest option

- 3. Failing to review coverage needs annually

- 4. Neglecting to insure business assets

- 5. Having inadequate business interruption coverage

- 6. Not insuring for potential lawsuits

- 7. Failing to insure key employees/partners

- 8. Ignoring cyber risks

- 9. Not insuring for natural disasters

- 10. Not getting proper endorsements

- 11. Relying on insurance agent’s recommendations alone

- Frequently Asked Questions

- In Conclusion

1. Not having general liability insurance

One of the biggest mistakes that small businesses make when buying insurance is neglecting to secure general liability coverage. This type of insurance is designed to protect your business from potential lawsuits and claims that may arise from accidents or damages that occur on your property or as a result of your business operations.

Without general liability insurance, your business is exposed to significant financial risks. Any injury or property damage that occurs due to your business activities could result in costly legal battles and hefty settlement payments. It’s important to remember that accidents can happen to anyone, and even one incident can have a devastating impact on your business.

Another consideration is that many clients and vendors may require proof of general liability insurance before entering into contracts with your business. Not having this coverage can limit your opportunities and hinder your growth potential. By obtaining general liability insurance, you demonstrate a commitment to protecting both your business and your customers, enhancing your credibility and trustworthiness in the eyes of potential partners.

When purchasing general liability insurance, it’s crucial to carefully evaluate your business’s specific needs and choose a policy that offers adequate coverage. Factors to consider include the nature of your business, the number of employees, and the level of risk associated with your operations. By investing in general liability insurance, you can safeguard your business, minimize potential liabilities, and gain peace of mind in an unpredictable world.

2. Buying insurance from the cheapest option

We all love a good bargain, but when it comes to protecting your small business, opting for the cheapest insurance policy might not be the wisest choice. While affordability is important, there are several key factors to consider before making a decision solely based on price.

First and foremost, it’s essential to thoroughly assess the coverage offered by the cheapest option. Insurance policies can vary greatly in terms of the protection they provide, so make sure the policy adequately addresses the specific needs of your business. Buying insurance solely based on price may result in insufficient coverage, leaving your business vulnerable to potential risks and liabilities.

Furthermore, it’s crucial to consider the financial stability and reputation of the insurance provider. Cheaper options might come from companies that lack a solid track record or have a history of poor customer service. Remember, you want an insurance company that will be there to support you when you need them the most. Take the time to research and read reviews to ensure you’re choosing a reliable and reputable insurer.

Another pitfall of buying insurance solely based on cost is the potential for hidden fees and exclusions. While some policies may offer an attractive premium, they could surprise you with unexpected costs or exclude crucial coverage that you assumed was included. It is critical to review the policy documents carefully and consult with an insurance professional to understand the terms, conditions, and any possible additional fees attached to the seemingly low-cost option.

Lastly, remember that the cheapest option may not offer the necessary flexibility to meet the evolving needs of your business. As your small business grows and expands, it’s essential to have insurance coverage that can adapt and provide ample protection. Cheaper policies may come with rigid terms and limited options for customization, restricting your ability to tailor the coverage to your unique business requirements.

In conclusion, while price is undeniably a factor to consider when purchasing insurance for your small business, it shouldn’t be the sole determinant. It’s crucial to assess the coverage, financial stability, reputation of the provider, hidden costs, and policy flexibility to make an informed decision. Invest in insurance that strikes the right balance between affordable premiums and comprehensive protection, ensuring the long-term success and security of your business.

3. Failing to review coverage needs annually

When it comes to insurance, small businesses often make the crucial mistake of neglecting to review their coverage needs on an annual basis. This oversight can lead to major gaps in protection and potentially devastating financial consequences should a disaster strike. It’s essential for small business owners to understand that their coverage needs can evolve over time, and failing to adapt accordingly leaves them exposed to unnecessary risks.

One of the primary reasons why businesses fail to review their coverage needs is simply a lack of awareness. With the constant whirlwind of day-to-day operations, it’s easy to lose sight of the importance of staying up to date with insurance policies. However, this negligence can prove to be a costly oversight in the long run.

To avoid falling into this trap, small business owners should prioritize scheduling an annual review of their coverage needs. This review should take into account any changes in the business, such as growth, new partnerships, or the launch of new products or services. It’s also essential to consider external factors that might affect insurance requirements, such as changes in industry regulations or emerging risks.

During the annual review, small business owners should carefully assess their existing policies to identify any gaps or limitations that need to be addressed. It’s crucial to ensure that the coverage adequately protects the business against potential risks and liabilities. Seeking professional advice from an insurance agent or broker can be invaluable in this process, as they can provide expert guidance and help identify any blind spots.

4. Neglecting to insure business assets

One of the most common mistakes small businesses make when purchasing insurance is neglecting to insure their business assets. Your business assets are the very foundation of your company, and without them, your operations could come to a halt. Yet, many small business owners underestimate the importance of protecting their physical assets, such as buildings, equipment, inventory, and vehicles.

By not insuring your business assets, you expose yourself to significant financial risks. Imagine the devastation of a fire destroying your office space or a break-in leaving you without valuable equipment. Without insurance coverage, you would have to bear the full cost of replacing these assets, potentially leading to a financial burden that your business may not be able to recover from.

Moreover, insuring your business assets is not limited to only protecting against physical damage. It also includes coverage for theft, vandalism, and natural disasters. Depending on your location and industry, specific risks may vary, but having comprehensive insurance coverage ensures that your business is safeguarded against unforeseen circumstances.

Remember, insurance is a crucial investment for small businesses, and neglecting to insure your business assets can have long-lasting consequences. Take the time to evaluate your assets and their value to determine the appropriate coverage needed. By proactively insuring your assets, you are safeguarding your business’s future and ensuring its ability to recover from any unexpected events that may arise.

5. Having inadequate business interruption coverage

can be a disastrous mistake for small businesses. This type of coverage is designed to protect your business from the financial fallout of unexpected disruptions, such as natural disasters or other unforeseen events. Without proper coverage, your business could face significant financial losses that could be difficult to recover from.

One common mistake small businesses make is underestimating the potential impact of business interruption. Many business owners assume that their regular property or general liability insurance will cover any losses resulting from interruptions. However, these policies typically only cover physical damages and may not account for lost income or ongoing expenses.

It is crucial to carefully assess and estimate the potential costs of business interruption. This includes considering factors like lost revenue, increased expenses, and the time it may take to fully recover. Taking the time to properly evaluate and understand your business interruption needs will ensure you can purchase adequate coverage.

When purchasing business interruption coverage, it’s important to carefully review the policy terms and conditions. Some policies may contain exclusions or limitations that could leave you vulnerable in certain situations. It’s also important to consider the sufficient period of indemnity, as this specifies how long your coverage will last following an interruption. Ensure that the policy aligns with your business’s unique needs and risks.

6. Not insuring for potential lawsuits

When it comes to running a small business, safeguarding yourself against potential lawsuits is crucial. However, one common mistake many small business owners make is not properly insuring themselves in this regard. Ignoring the possibility of legal disputes can be a costly oversight that can jeopardize the financial stability of your business. Here are a few key reasons why can be a detrimental move:

1. Financial Burden:

Being involved in a lawsuit, whether it is brought by an employee, customer, or another external party, can quickly drain your financial resources. Not having the appropriate insurance coverage can leave you personally liable for legal expenses, which may include attorney fees, court costs, and settlement fees. This financial burden can severely impact your ability to continue operating and may even lead to the closure of your business.

2. Reputation Damage:

A lawsuit can harm your business’s reputation, regardless of the outcome. News travels fast, and negative publicity surrounding legal disputes can deter potential customers and business partners. By failing to insure against lawsuits, you risk tarnishing the trust and credibility that you have worked so hard to build.

3. Legal Compliance:

Laws and regulations governing businesses are complex and ever-evolving. Not having insurance coverage tailored to your industry and specific risks can put you at odds with legal requirements. Should a legal dispute arise, the absence of appropriate coverage may have legal implications, putting you on the wrong side of the law.

4. Peace of Mind:

Running a small business is challenging enough. By securing insurance coverage for potential lawsuits, you can have peace of mind knowing that you are protected against unforeseen legal battles. Being proactive in insuring for lawsuits provides a safety net that allows you to focus on your business’s growth and success without the constant worry of legal threats hanging over your head.

7. Failing to insure key employees/partners

When it comes to protecting your small business, don’t overlook the importance of insuring your key employees and partners. These individuals play a crucial role in the success and growth of your company, so it’s essential to have a plan in place to ensure their well-being and continuity of operations.

By investing in key employee insurance, you can safeguard against the unexpected. In the event of a critical illness, disability, or even death, the financial consequences can be severe for your business. Key employee insurance provides a safety net, covering expenses such as hiring and training replacements, loss of revenue, and loan payments.

Remember, losing a key employee can disrupt your operations, result in lost opportunities, and even jeopardize important relationships with customers or suppliers. By securing adequate insurance for your key personnel, you can minimize these risks and maintain business continuity during challenging times.

Identifying who qualifies as a key employee is crucial. Consider those individuals who possess specialized skills, knowledge, or relationships that are integral to your business. Whether it’s your top salesperson, an indispensable project manager, or a key partner, ensuring their well-being means protecting the foundation upon which your business depends.

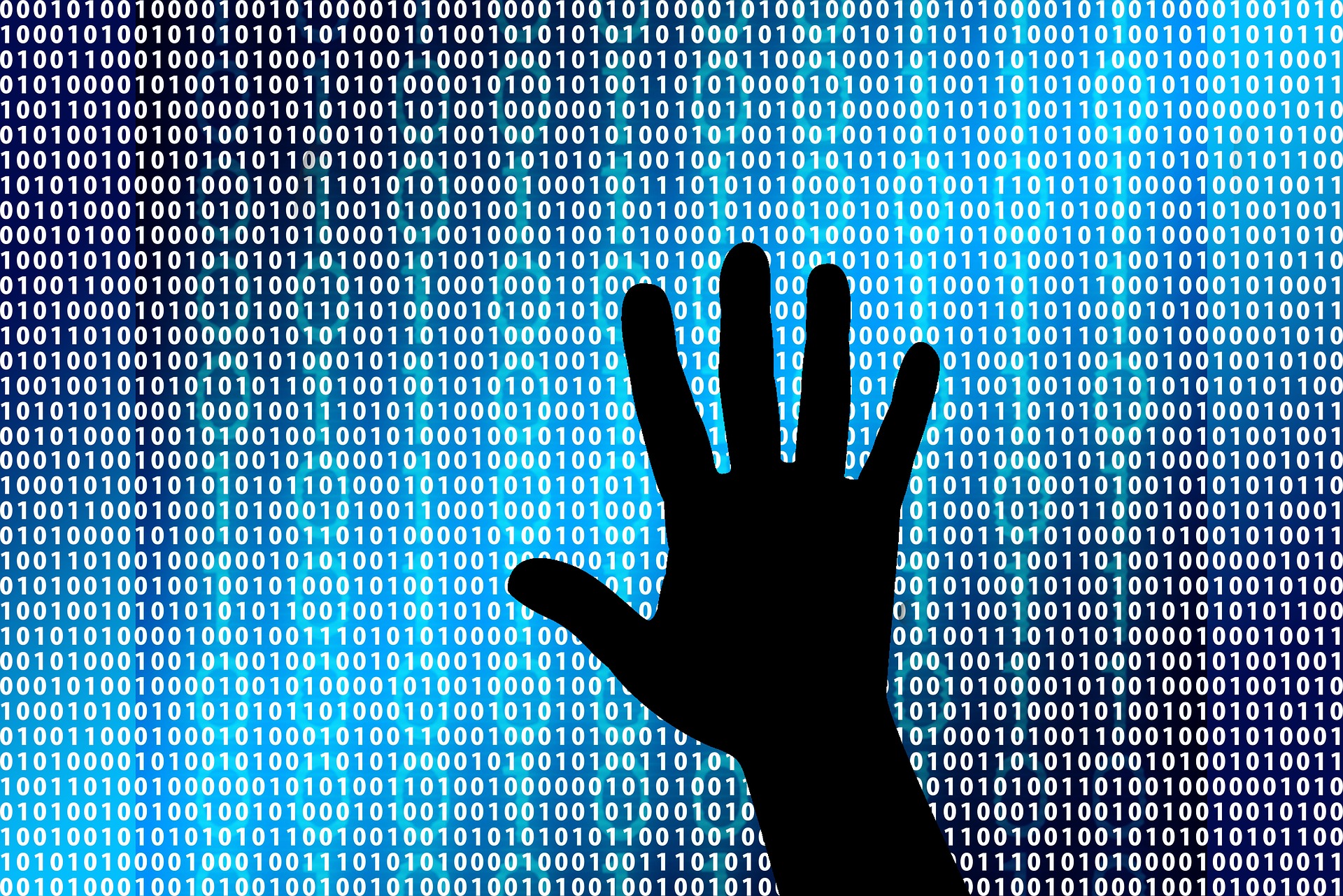

8. Ignoring cyber risks

Small businesses often overlook the importance of cyber risks, which can have devastating consequences for their operations. Ignoring these risks exposes companies to potential data breaches, financial losses, and reputation damage. It is crucial for small business owners to understand the gravity of cyber threats and take necessary steps to protect themselves from this growing menace.

1. Underestimating the threat: One common mistake is underestimating the severity of cyber risks. Small businesses, in particular, may assume that they are not a target for hackers because of their size or industry. However, cybercriminals often target smaller organizations precisely because they are more vulnerable and have fewer resources for cybersecurity. It is vital for businesses to recognize that anyone can fall victim to a cyber attack, regardless of their size.

2. Lack of employee training: Employees are often the weakest link when it comes to cybersecurity. Small businesses frequently neglect to provide adequate training to their staff on best practices for handling sensitive data, identifying phishing attempts, and using secure passwords. Without regular training and awareness programs, employees may unknowingly jeopardize the company’s cybersecurity defenses.

3. Insufficient cybersecurity measures: Another mistake is failing to implement robust cybersecurity measures. Small businesses should invest in firewalls, antivirus software, and encryption tools to protect their networks, devices, and data. Regular software updates and patch installations are also essential to address security vulnerabilities. Taking these steps can significantly reduce the risk of a cyber attack and safeguard sensitive information.

4. Lack of contingency planning: Small businesses often overlook the need for a contingency plan in the event of a cyber attack. Having a contingency plan ensures that businesses can respond effectively and minimize damage if a breach occurs. It involves steps such as regularly backing up data, creating incident response procedures, and monitoring systems for suspicious activity. By being prepared, businesses can recover more quickly and mitigate the impact of a cyber attack.

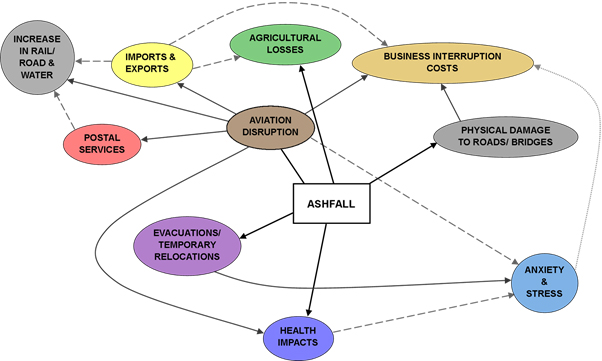

9. Not insuring for natural disasters

One of the most common mistakes small businesses make when it comes to insurance is not insuring themselves adequately against natural disasters. While we all hope that such events never occur, the reality is that Mother Nature can be unpredictable. Failing to include coverage for natural disasters in your insurance policy can leave your business vulnerable and expose you to massive financial losses.

Imagine if a hurricane or earthquake were to strike your area, causing extensive damage to your business premises and valuable equipment. Without insurance, not only would you have to bear the cost of repairing or replacing everything out of your own pocket, but you may also have to deal with the prolonged interruption of your operations. This could mean loss of customers, missed deadlines, and a tarnished business reputation.

By including natural disaster coverage in your insurance policy, you can protect your business from these unexpected events. This coverage typically includes damages caused by earthquakes, hurricanes, floods, wildfires, and other natural calamities. And remember, it’s not just the physical damage that you need to worry about; natural disasters can result in additional expenses, such as temporary relocation costs, extra transportation fees, and increased utility bills.

When choosing natural disaster coverage, consider the specific risks your business faces based on its location. For instance, if your business is located in an area prone to earthquakes, you should ensure your policy covers earthquake damages. It’s also important to review your coverage limits and deductibles to ensure they adequately protect your business in the event of a natural disaster. Remember, it’s always better to be safe than sorry when it comes to protecting your small business.

10. Not getting proper endorsements

One common mistake that small businesses make when purchasing insurance is overlooking the importance of proper endorsements. Endorsements are additional documents or clauses that modify or add coverage to your insurance policy. Neglecting to obtain the necessary endorsements can leave your business exposed to potential gaps in coverage.

Proper endorsements can be crucial in tailoring your insurance policy to suit the unique needs of your business. For example, if your business operates in a high-risk industry such as construction, you may need an endorsement that specifically covers liability arising from construction-related accidents. Similarly, if you rely heavily on technology, obtaining an endorsement for cyber liability coverage is essential in today’s digital world.

By not taking the time to review and obtain the appropriate endorsements for your insurance policy, you run the risk of financial loss and legal complications. Without these endorsements, you might find your business facing unexpected expenses that could have been covered by the proper insurance. Moreover, if a claim arises and you are unable to prove that you have the necessary endorsements, your insurer may deny coverage.

To avoid these pitfalls, it is crucial to thoroughly assess the unique risks faced by your small business and seek professional guidance. An experienced insurance agent can help you identify the endorsements necessary to adequately protect your business. Taking the time to understand and obtain proper endorsements will not only provide you with peace of mind but also ensure that your business is well-covered in the face of unexpected events.

11. Relying on insurance agent’s recommendations alone

When it comes to purchasing insurance for your small business, it’s important to make informed decisions rather than relying solely on your insurance agent’s recommendations. While insurance agents are knowledgeable professionals, there are several reasons why it’s crucial to do your own research and make independent choices:

- Understanding your unique needs: No one knows your business better than you do. By taking the time to thoroughly assess your company’s risks and requirements, you can ensure that the insurance coverage you select is tailored to your specific needs.

- Comparing policies and prices: Insurance agents may have preferences or partnerships with certain insurance companies, which can influence their recommendations. By exploring multiple options and comparing policies, you can find competitive pricing and coverage terms that align with your budget and risk tolerance.

- Exploring additional coverage: Insurance agents, while well-intentioned, might not always suggest all the insurance options available to you. By researching and understanding various insurance products yourself, you can identify potential coverage gaps, explore additional endorsements, or consider specialized policies that are relevant to your business.

- Gaining a broader perspective: Each insurance agent has their own expertise and knowledge, which may limit the scope of their recommendations. By seeking information from multiple sources, such as online resources, industry publications, and business advisors, you can gather a wider range of insights and perspectives, helping you make more informed choices.

Frequently Asked Questions

Q: Looking to avoid insurance pitfalls? Wondering what mistakes small businesses commonly make when purchasing insurance? Look no further! Welcome to the creativity-packed Q&A session on the “Top 11 Mistakes Small Businesses Make When Buying Insurance” article. Let’s dive right in!

Q: What is the first mistake small businesses often make when purchasing insurance?

A: Many small businesses overlook the importance of adequate coverage. They might get lured by the enticingly low premiums, failing to realize that insufficient coverage could lead to disastrous consequences.

Q: Are there specific areas where small businesses tend to skimp on coverage?

A: Absolutely! Another common mistake is neglecting essential coverage areas like general liability and professional liability insurance. By focusing solely on the cost, they may leave themselves vulnerable to unexpected claims or lawsuits.

Q: Can you shed some light on another mistake businesses frequently make?

A: Indeed! Getting swayed by the “one-size-fits-all” illusion is a significant blunder. Small businesses often opt for generic policies without considering the unique risks in their industry. Ignoring specialized coverage can leave them exposed and inadequately protected.

Q: How about the importance of reviewing policies before renewal?

A: Excellent question! Many small businesses hastily renew their policies without thoroughly reviewing the coverage details. By taking a lazy approach, they may overlook crucial updates in their needs, resulting in coverage gaps or unnecessary expenses.

Q: Do small businesses often neglect to read the fine print?

A: Ah, the tiny font! Small businesses frequently skim through the policy documents without giving them a thorough read. As a result, they miss essential details, such as exclusions and limitations, which can come back to haunt them when filing a claim.

Q: Are there instances where businesses overestimate their coverage needs?

A: Absolutely! Some businesses stumble into the pitfall of overestimating their coverage requirements. By purchasing excessive coverage, they end up spending more than necessary for protection they don’t actually need, draining their finances unnecessarily.

Q: What about the mistake of failing to update coverage as the business evolves?

A: Spot on! Many small businesses forget that their insurance needs evolve alongside their operations. Without regularly reassessing and updating their coverage, they might end up with insufficient protection, leaving potential risks unaccounted for.

Q: Can you tell us about businesses underestimating the value of employee benefits coverage?

A: Of course! Small businesses sometimes overlook the importance of employee benefits coverage, such as health insurance or workers’ compensation. Failing to provide these essential benefits can hamper their ability to attract and retain talented employees.

Q: What other mistakes do small businesses commonly make when buying insurance?

A: Another familiar mishap is relying solely on a single insurance provider. Small businesses might miss out on alternative options with better coverage or more attractive rates. Exploring multiple providers can help find the perfect fit for their unique needs.

Q: Is there a mistake related to not understanding deductibles?

A: Absolutely! Failing to comprehend deductibles is a typical oversight. Small businesses might opt for lower deductibles, thinking it will reduce their costs. However, this can lead to higher premiums, affecting their overall financial health.

Q: Can you share a final mistake that businesses frequently commit?

A: Of course! One major mistake is not seeking professional guidance from insurance experts. Small businesses often try to navigate the complex world of insurance on their own, missing out on valuable advice that can help them make informed decisions.

Final Thoughts

As we bid adieu to this enlightening journey through the perplexing world of insurance, we hope to have shed light on the top 11 common pitfalls that small businesses inadvertently tumble into. Remember, when it comes to safeguarding your entrepreneurial dreams, knowledge is the key.

In our quest to unravel the intricacies of insurance purchasing, we have witnessed both epic successes and woeful failures. But fear not, dear readers, for we stand poised to guide you away from the treacherous path of missteps and towards the promised land of responsible decision-making.

We beseech you, small-business owners, to heed our counsel and avoid the siren call of these insurance blunders. Recognize that failing to assess your risks in their entirety or underestimating the power of research can lead to dire consequences. Acknowledge the importance of properly valuing your assets and tailoring coverage to your specific needs, for no two enterprises are alike.

Delicate art it may be, selecting the right insurance policy requires prudence, patience, and profound understanding. Oh, the tales we could tell of those who trusted the wrong insurer, only to be left high and dry when calamity struck. Spare yourself the agony of misplaced trust and equip yourself with the wisdom we’ve imparted.

Yet, dear reader, let us not forget the equally perilous realm of underinsuring or over insuring – a tightrope walk between vulnerability and unnecessary expense. Strike that elusive balance, and you shall be rewarded, like a well-seasoned tightrope dancer wowing the crowd.

As we draw the curtain on this riveting journey, remember that prevention is better than cure. Cultivate a relationship with your insurance provider, nurture open communication, and revisit your coverage regularly to adapt to the ever-changing landscape of your business.

In culmination, let us toast to the eradication of these common pitfalls. May your insurance endeavors be marked by prudence, foresight, and an unyielding commitment to protecting your small-business empire. Go forth, dear readers, and conquer the world - fortified by the knowledge you have gained.